The four different types of trusts. A trust is a three party financial.

What Type Of Trust Is Right For You

What Type Of Trust Is Right For You

Trusts can be complicated but useful.

What type of trusts are there. If the trust was a trust identified as code 11 22 or 23 and the trust is continued after the death of the last surviving lifetime beneficiary either the settlor or the spouse or common law partner as the case may be use trust type code 300 other trust on all t3 returns filed for a tax year ending after the date of death. Accordingly there are many types of trusts each corresponding to a different goal or financial situation. However generally the common unifying reason and purpose for creating a trust is to hold some sort of property in the trust for the benefit of another person or party.

These types of trusts are often set up in countries outside of the united states although the assets do not always need to be transferred to the foreign jurisdiction. Income tax law classifies trusts in three categories. Living trusts and testamentary trusts.

What are some common types of trusts. There are four main categories of trusts which are based on when it goes into effect and who owns the assets. Living and testamentary trusts where the trust distributes all of its income every year to a trust beneficiary.

There are several reasons why you might decide to establish a trust. There are other unique types of trusts but the categories mentioned above are the most basic and important to know. This type of trust allows the trustor to benefit from.

Thestreet gives you a full rundown on what a trust is and the different kinds of trusts out there. Used in estate planning elder care planning and other forms of financial management trusts can provide protection from taxation as well as clear control of the dispensation of assets after someone dies. A living trust or an inter vivos trust is set up during the persons lifetime.

Understanding how the different types of trusts work can help you decide which one to use in your estate plan. If youre unsure about the type of trust you want to establish you should consult a licensed trusts and estates attorney in your state. Treated as if the grantor owns the trust property so the grantor is subject to tax on the income of the trust.

There are two basic types of trusts. Just like ice cream there are many types of trusts out there. An asset protection trust is a type of trust that is designed to protect a persons assets from claims of future creditors.

A testamentary trust is set up in a. As mentioned above there are many different reasons that a trust may be created.

Family Trusts Danie Potgieter Attorneys

Family Trusts Danie Potgieter Attorneys

Trusts Safeguarding An Inheritance Captrust

Trusts Safeguarding An Inheritance Captrust

Iko All Type Of Trust Ball Bearing Thrust Roller Bearings Axk3552

Trusts Who Benefits From Them And How Rod Cunich

Valued Or Exploited Workingoutloud On Types Of Trust Julian

Valued Or Exploited Workingoutloud On Types Of Trust Julian

Common Types Of Trusts In Singapore Fortis Law Your Key To

Common Types Of Trusts In Singapore Fortis Law Your Key To

Buy The Complete Book Of Trusts Book Online At Low Prices In India

Buy The Complete Book Of Trusts Book Online At Low Prices In India

Trust Type Rights Plan Product Expectations Products Trusts

Trust Type Rights Plan Product Expectations Products Trusts

Trusts Travis Ford Attorney Mountain Home Ar

Trusts Travis Ford Attorney Mountain Home Ar

Revocable Trusts Living Trusts Arden Law Firm Llc 410 216

1 Types Of Trust And Examples Download Table

1 Types Of Trust And Examples Download Table

Newport Beach Estate Planning Attorney Can I Use A Revocable

What Type Of Trusts Protect Assets Connecticut Estate Planning

What Type Of Trusts Protect Assets Connecticut Estate Planning

![]() Different Types Of Legal Trusts Thenbxpress Com

Different Types Of Legal Trusts Thenbxpress Com

Calameo You Earned It Now Protect It With An Irrevocable Trust

Calameo You Earned It Now Protect It With An Irrevocable Trust

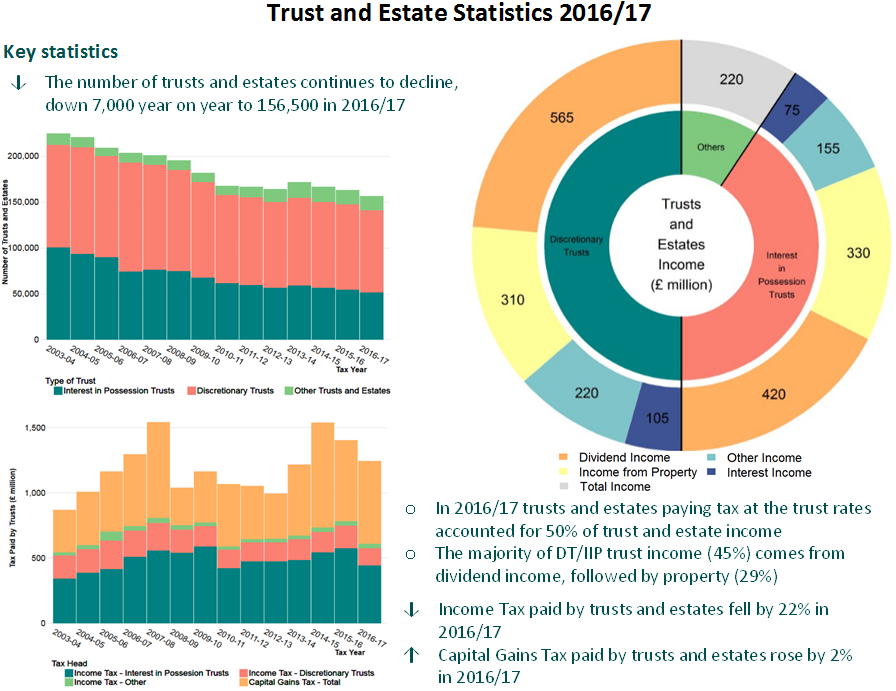

2 4 Capital Gains Tax And Trusts

2 4 Capital Gains Tax And Trusts

Any Person Desiring To Start Any Type Of Trust In India Is It The

Any Person Desiring To Start Any Type Of Trust In India Is It The