The grantor settlor or trustor of a trust decides how the trust will operate including. In other words the grantor of a trust contract is the owner of the assets which could be any asset from personal residential real estate to stock accounts to business or partnership assets and anything else of monetary value.

Grantor Lead Trust Women In Distress

Grantor Lead Trust Women In Distress

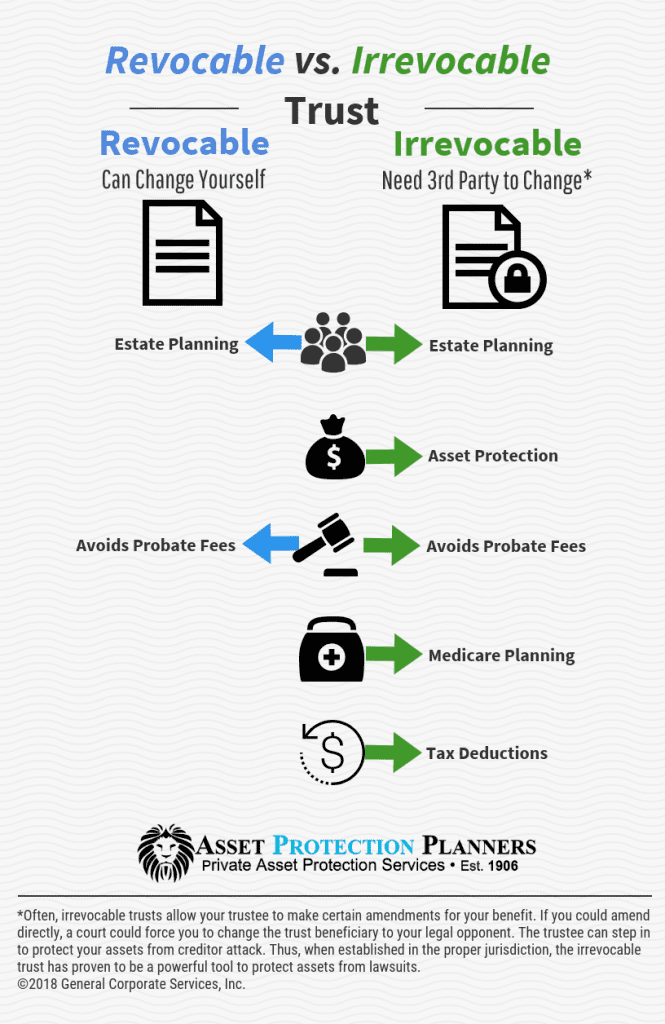

Can be changed or terminated until the grantor.

Who is the grantor in a trust. This trust allows the grantor the individual who establishes the trust to have control over the trust assets and receive income that is created from the trust. These terms are often interchangeable. In some cases a trust can be treated as a grantor trust when a third person nonadverse to the grantor holds an interest or control over the.

One type of grantor trust that is useful in estate planning is a grantor trust. Revocable living trusts are the most common type of grantor trust. What happens to a trust when the grantor or trust creator dies depends on the terms of the trust.

The grantor trust is often called a living trust or a revocable trust. As noted a grantor trust is an effective estate planning tool. In simple terms a grantor trust is a trust in which the grantor the creator of the trust retains one or more powers over the trust and because of this the trusts income is taxable to the grantor.

Grantor trusts and non grantor trusts are the two main types of funded trusts trusts that hold assets. All trusts have a grantor the person who creates. The grantor is the person who declares the trust and then transfers property to the trustee.

The grantor in a trust is the person with the bucks. In a testamentary trust the decedent is the grantor. When the trust is revocable ie.

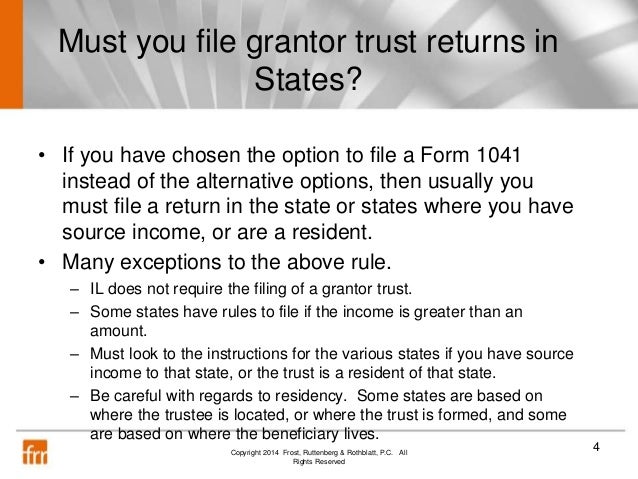

The type of trust youre administering determines whether you must file form 1041 for the trust or declare all items of income and deduction on the grantors form 1040. The grantor trust rules allow grantors to control the assets and investments in a trust. Definition of a grantor settlor or trustor of a trust.

What property to include in the trust who the beneficiaries will be and how beneficiaries will receive their inheritance. The income it generates is taxed to the grantor at his or her tax rate rather than to the trust itself. Since a trust represents a fiduciary relationship regulated by state law independent of the grantor a trust can continue in existence long after the grantor dies.

In the typical grantor trust scenario the grantor is the person making all of these decisions and he or she assumes the tax liability and the trust is ignored for income tax purposes. That person can also be called the testator. After they transfer the property they no longer own it.

The grantor in a living trust is the person who executes or creates the trust and then transfers their property to the trustee.

How To Explain Sell More Grats Grantor Retained Annuity Trust

How To Explain Sell More Grats Grantor Retained Annuity Trust

How To Transfer Wealth Using Grats Grantor Retained Annuity

How To Transfer Wealth Using Grats Grantor Retained Annuity

Leverage Your Clients Tax Benefits By Using Grantor Trust Power Of

Leverage Your Clients Tax Benefits By Using Grantor Trust Power Of

:brightness(10):contrast(5):no_upscale()/living-trust-documents-172737338-5ad0e56ea9d4f9003de30b58.jpg) Grantor Trusts And What They Mean To Your Taxes

Grantor Trusts And What They Mean To Your Taxes

What Happens To A Revocable Trust When The Trustee Dies

What Happens To A Revocable Trust When The Trustee Dies

How Irrevocable Trusts Work Video Explains Details

How Irrevocable Trusts Work Video Explains Details

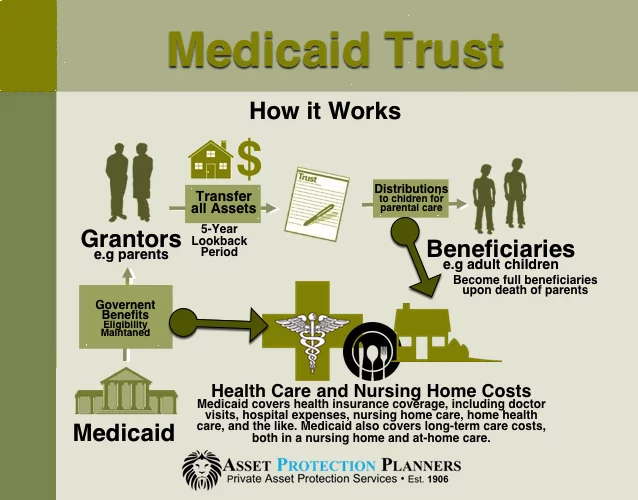

Medicaid Trust For Asset Protection From Nursing Home Costs

Medicaid Trust For Asset Protection From Nursing Home Costs

Grantor Retained Annuity Trusts Grat Williams Mullen

Grantor Retained Annuity Trusts Grat Williams Mullen

Foreign Grantor Trust Bridgeford Trust Company

Foreign Grantor Trust Bridgeford Trust Company

Free Florida Revocable Living Trust Form Pdf Word Eforms

Free Florida Revocable Living Trust Form Pdf Word Eforms

For A Gift Of Family Real Estate Consider The Value Of An Idgt

For A Gift Of Family Real Estate Consider The Value Of An Idgt

The Perils And Pitfalls Of Grantor Trust Triggers Wealth Management

The Perils And Pitfalls Of Grantor Trust Triggers Wealth Management

Http Www Blankrome Com Sitefiles Privateclient Idgts Pdf

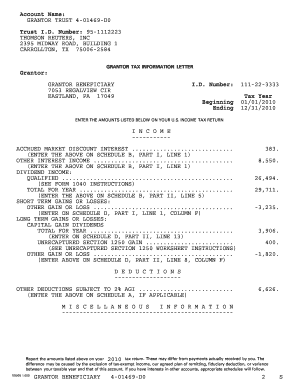

Grantor Letter Fill Out And Sign Printable Pdf Template Signnow

Grantor Letter Fill Out And Sign Printable Pdf Template Signnow

Accountants Guide To Grantor Trusts 111714

Accountants Guide To Grantor Trusts 111714

Why Would Anyone Create An Intentionally Defective Grantor Trust