What is life insurance. As a single parent youre the caregiver breadwinner cook chauffeur and so much more.

Why Buy Life Insurance Infographic Usaa

Why Buy Life Insurance Infographic Usaa

Well show you.

Who is life insurance for. Some insurance companies have specific programs for certain disabilities. Make sure you know how to choose the best type for your needs get clued up on the pitfalls to avoid and discover some simple ways to cut the costs. Life insurance is an important decision.

Life insurance policies for people with disabilities. Only the beneficiaries named on policies can collect death benefits. Life insurance makes sure that your plans for the future dont die when you do.

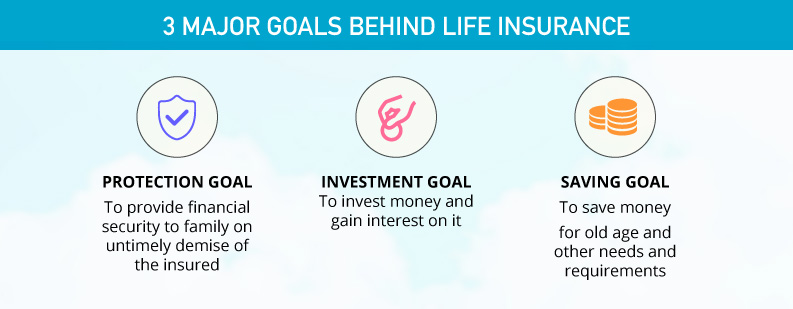

Life insurance can be a crucial safety net for families. Typically life insurance is chosen based on the needs and goals of the owner. Life insurance is a protection against financial loss that would result from the premature death of an insured.

The two main types of life insurance are term life insurance and whole of life insurance. Who can collect the life insurance death benefit. The named beneficiary receives the proceeds and is thereby safeguarded from the.

When you take out term life insurance there is usually a maximum term you can apply for and could pay out a cash sum if you die during that period of cover. Term life insurance generally provides protection for a set period of time while permanent insurance such as whole and universal life provides lifetime coverage. Paula tremblay media relations staff member at massmutual said the company offers a program for individuals with disabilities and their families.

There are several different kinds of life insurance. Yet nearly four in 10 single parents have no life insurance and many with coverage say they need more than they have. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

Its important to note that death benefits from all types of life insurance are generally income tax. Youre a single parent. What types of life insurance are available in the market.

This is why its so important for policy owners to regularly review their life insurance decisions to make sure the named beneficiaries still are the people who should collect the money especially if youve experienced major life changes. We analyzed the best life insurance companies of 2020 so you can find the best life insurance policy for your needs.

Reasons To Have Life Insurance Life Insurance

7 Reasons Parents Should Have Life Insurance Teensgotcents

Life Insurance Scripts And Training Allstar Marketing

Life Insurance Scripts And Training Allstar Marketing

Is Mortgage Life Insurance The Best Deal Out There

Is Mortgage Life Insurance The Best Deal Out There

5 Reasons Why Life Insurance Is Important Getinsurance

5 Reasons Why Life Insurance Is Important Getinsurance

Life Insurance What You Need To Know Advantage Insurance Solutions

Life Insurance What You Need To Know Advantage Insurance Solutions

10 Year Term Life Insurance Quote What Are The Differences

10 Year Term Life Insurance Quote What Are The Differences

5 Questions About Corporate Wellness And Life Insurance

5 Questions About Corporate Wellness And Life Insurance

When Life Insurance Companies May Reject A Claim Nerdwallet

When Life Insurance Companies May Reject A Claim Nerdwallet

Life Insurance Kd Financial Services

How To Get Life Insurance For Parents The Ultimate Guide Buy

How To Get Life Insurance For Parents The Ultimate Guide Buy

178 Best Life Insurance Images Life Insurance Life Insurance

178 Best Life Insurance Images Life Insurance Life Insurance

Non Life Insurance Products Docsity

Non Life Insurance Products Docsity

Life Insurance Plans Policies In India

Life Insurance Plans Policies In India

Why Is Life Insurance Important Financial Mentor

Why Is Life Insurance Important Financial Mentor

Life Insurance A Basic Overview

Life Insurance A Basic Overview