You dont have to be a rockefeller to need a trust. Remember a living trust does nothing for you during your life.

What Do I Need To Know About Special Needs Trusts

What Do I Need To Know About Special Needs Trusts

What is a living trust and do you need one.

When do i need a trust. No one likes to think about dying but when it comes to managing your finances you have to be prepared for the inevitable. A common question an estate planning attorney is asked by clients is how do i figure out if i need a trust instead of a just will many people assume that revocable living trusts are just for wealthy people but the benefits that they can offer to someone with even minimal wealth are significant. Living trusts often do not make sense for middle income people in decent health who are under the age of 55 or 60.

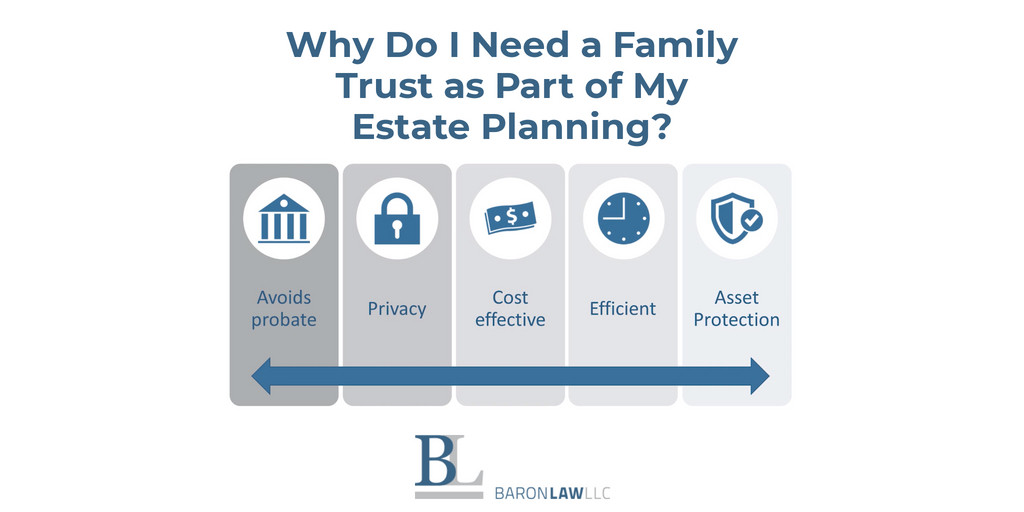

An estate plan that includes a trust costs 1000 to 3000 versus 300 or less. To avoid probate court and streamline the wealth transfer process for your heirs a revocable trust also known as a living trust. Clients often ask why do i need a trust this question comes up even more frequently since congress passed the tax cuts and jobs act of 2017 which increased the federal estate tax.

For example a trust can be more expensive and complicated to draft than a will. How old are you. Id call them trade offs.

Here are some factors to consider when deciding if you need a revocable living trust instead. And then lets wrap up with why you should absolutely have. What is a revocable trust and do i need one.

Rebecca lake jan 07 2020. Sitting down with an estate planning attorney can be very expensive particularly if you dont know what you want or need from the trust. But given the expenses associated with opening one its probably not worth it.

Having a solid estate plan in place can ensure that your family is taken care of after youre gone. If you have heard the term living trust floating around youve probably wondered do i need a living trust as with many legal questions the answer is maybe so lets talk more about what a living trust is how it differs from a last will and what you should consider when deciding whether to make a living trust or not. All too often though theyre sold to people who dont need them says sally hurme a project adviser for aarp.

Rather a durable power of attorney and an advance medical directive should be sufficient in naming someone to help you manage your finances should you become incapacitated. To decide if you need a living trust consider these factors. If you possess only a few bank accounts some life insurance and a 401k retirement plan a revocable living trust is probably excessive.

A trust can be a useful estate planning tool for lots of people. Of course youll also need a last will and. What types of assets do you own.

Are there any disadvantages to trusts.

Do I Need A Living Trust Benefits And Drawbacks Realwealth

Do I Need A Living Trust Benefits And Drawbacks Realwealth

Do I Need Both A Will And A Living Trust Fouts Law Group

Do I Need Both A Will And A Living Trust Fouts Law Group

Why You Need Trust To Do Business Crash Course Business Soft

Why You Need Trust To Do Business Crash Course Business Soft

:brightness(10):contrast(5):no_upscale()/estate-planning-173899060-578d1f913df78c09e928d2c4.jpg) Is A Revocable Living Trust Right For You

Is A Revocable Living Trust Right For You

Why Do I Need A Family Trust As Part Of My Estate Planning

Why Do I Need A Family Trust As Part Of My Estate Planning

Liz Weston Do You Need A Trust If You Have A Will Oregonlive Com

Liz Weston Do You Need A Trust If You Have A Will Oregonlive Com

Do I Need A Trust If My Child Is Disabled Transition Plan Help

Do I Need A Trust If My Child Is Disabled Transition Plan Help

Trust Litigation Lawyers California Bohm Wildish Matsen Llp

Trust Litigation Lawyers California Bohm Wildish Matsen Llp

When Do I Need A Tax Id Number For A Trust Los Angeles Estate

When Do I Need A Tax Id Number For A Trust Los Angeles Estate

Do I Really Need A Trust Blum Propper Hardacre Inc

Do I Really Need A Trust Blum Propper Hardacre Inc

Do I Need A Trust Probably At Least You Should Discuss It With

Do I Need A Trust Probably At Least You Should Discuss It With

Do I Need A Trust Mckinney Estate Planning Attorney Malolo Law

Do I Need A Trust Mckinney Estate Planning Attorney Malolo Law

Do I Need A Living Trust Or A Will Or Both Law Offices Of

Do I Need A Living Trust Or A Will Or Both Law Offices Of

Do You Need A Trust For Your Estate Plan

Do You Need A Trust For Your Estate Plan

Do I Need A Trust If I Have A Will Woven Capital