Other taxation applied to inheritance. Inheritance tax iht is paid when a persons estate is worth more than 325000 when they die exemptions passing on property.

Sipp Inheritance Tax I Inheriting A Sipp Interactive Investor

Sipp Inheritance Tax I Inheriting A Sipp Interactive Investor

This is when why federal estate taxing started.

When does inheritance tax start. An estate tax is levied on the value of a. Iowa kentucky maryland nebraska new jersey and pennsylvania. One thing that commonly confuses people is the difference between an inheritance tax and an estate tax.

When does the estate tax kick in. There is also a few states that impose an inheritance tax on the heirs of the assets of the deceased with rates varying based on the relationship with the deceased. The inheritance tax is imposed on both residents and nonresidents who owned real estate and tangible personal property in pennsylvania at the time of their death.

Our guide explains what iht is how to work out what you need to pay and when and some of the ways you can reduce this tax. Inheritance tax is a state tax on the receipt of assets from someone who died. How much you pay depends on the value of your estate which is valued based on your assets cash in the bank investments property or business vehicles payouts from life insurance policies minus any debts and liabilities.

The pennsylvania inheritance tax return form rev 1500 must be filed within nine months of the date of death. Modern inheritance tax dates back to 1894 when the government introduced estate duty a tax on the capital value of land in a bid to raise money to pay off a 4m government deficit. Sometimes known as death duties.

Inheritance taxation was generally imposed by the states so the government in all its wisdom enacted a federal tax too. For federal tax purposes inheritance generally isnt considered income. A guide to inheritance tax only a small percentage of estates are large enough to incur inheritance tax iht but you mustnt forget to factor this tax into your plans when you make your will.

Inheritance tax is a tax on the estate the property money and possesions of someone whos passed away. But in some states inheritances can be. For example if you live in a no inheritance tax state such as virginia but your great uncle who resided in maryland leaves you his checking account balance you could be on the hook for.

In 1916 congress for the.

Will My Children Pay Inheritance Tax On Our Home And Pension Inews

Will My Children Pay Inheritance Tax On Our Home And Pension Inews

Inheritance Taxation In Sweden 1885 2004 The Role Of Ideology

Inheritance Taxation In Sweden 1885 2004 The Role Of Ideology

Easy Ways To Cut Your Inheritance Tax Bill Moneywise

Easy Ways To Cut Your Inheritance Tax Bill Moneywise

Inheritance Taxation In Sweden 1885 2004 The Role Of Ideology

Inheritance Taxation In Sweden 1885 2004 The Role Of Ideology

Inheritance Tax Calculator Could Help Slash Your Iht Bill

Inheritance Tax Calculator Could Help Slash Your Iht Bill

Inheritance Tax In Ireland Free Guide

Inheritance Tax In Ireland Free Guide

Is There Such Thing As Estate And Inheritance Tax In Canada

Is There Such Thing As Estate And Inheritance Tax In Canada

Inheritance Tax Who Pays And Is It The Same As Estate Tax

Inheritance Tax Who Pays And Is It The Same As Estate Tax

We Are In The Paper Do You Or Your Family Need To Avoid

Estate Inheritance Tax Threshold Rates Calculating How Much

Estate Inheritance Tax Threshold Rates Calculating How Much

Estate And Inheritance Taxes Around The World Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

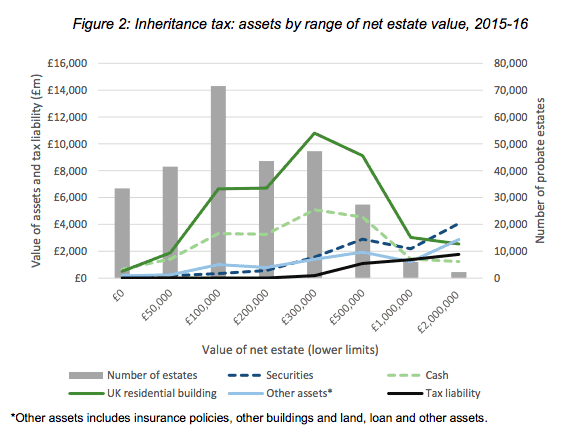

Uk Inheritance Tax Statistics Patrick Cannon

Uk Inheritance Tax Statistics Patrick Cannon

Huge Tax Cut For Families Coming In 2019 20 Which News

Huge Tax Cut For Families Coming In 2019 20 Which News

Estate And Inheritance Taxes Around The World Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

How To Avoid Inheritance Tax Legally This Is Money

How To Avoid Inheritance Tax Legally This Is Money

/inheritance-tax-121154566-5c4d27b346e0fb0001dddf27.jpg)