Who you name as a beneficiary can be just as important as your initial decision to purchase life insurance. Without knowing it it may be your favorite relative uncle sam.

Choosing A Life Insurance Beneficiary

Choosing A Life Insurance Beneficiary

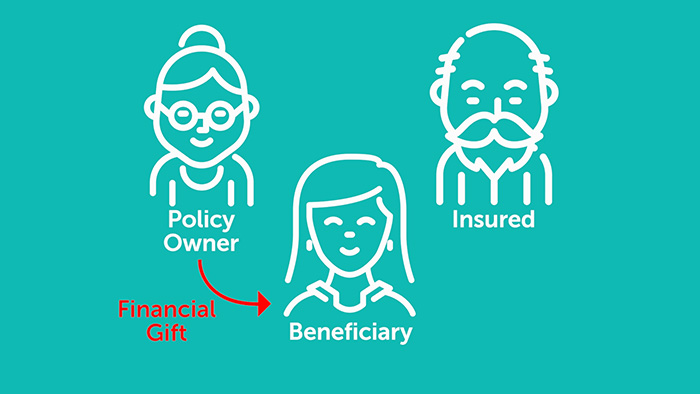

A life insurance beneficiary is typically the person or people who get the payout on your life insurance policy after you die.

Who should be beneficiary of life insurance. Its important to understand what a beneficiary is and how your life insurance policy works so you can come up with the best strategy to protect them. It is possible to name your property as a beneficiary on your life insurance policy. Every life insurance policy requires you to name a beneficiary.

You took an important step by protecting the ones you love. Listing your life insurance policies in your will can help loved ones to know that the coverage exists and can point them in the right direction in terms of collecting the benefit. What is a life insurance beneficiary designation.

Who should you name as a beneficiary. It may also be a trust charity or your estate. One substantial reason people purchase a life insurance policy is for peace of mind when it comes to family knowing that life insurance protection is in place in the event of your death.

Who you name as a beneficiary is unique to your own circumstances. In this case the money is taxed. Although this would be just a good idea in certain circumstances.

Moreover if a minor is the named beneficiary on the life insurance policy a guardian would most likely have to be appointed by the court following the death your death to manage the payout. Who is the beneficiary of your life insurance. If you think that you should be a life insurance beneficiary and you are not you can contest the designation and there are multiple grounds for doing so.

This article will explain those grounds. Its important however to know that regardless of what your will says the life insurance money will be paid to the beneficiary listed on the life insurance policy. Without considering life insurance most people need not worry about federal estate tax since your estate must now exceed 549 million in 2017 this is up from 545 million in 2016 to be subject to this levy.

No one likes to think about dying but a life insurance policy can be a critical tool of transition for your loved ones. When someone purchases life insurance he or she designated one or more named beneficiaries. Life insurance companies will generally not pay life insurance proceeds to minors.

Life insurance is important to protect your familys financial future. Its a big job which is why its important to choose the right person someone whos trustworthy and knows what matters most to you. First off great job on buying life insurance.

When you create a revocable living trust as part of your foundational estate plan it will be important for you to update the beneficiaries of your life insurance policieswhether youll need to change both the primary and secondary beneficiaries will generally be dependent upon your marital status and net worth. It is definitely advisable to name the beneficiary of the units because if you do not have one the insurance payment will be transferred to your property.

Life Insurance Standards And Options Finance And Economics

Life Insurance Standards And Options Finance And Economics

Non Life Insurance Products Docsity

Non Life Insurance Products Docsity

/What-is-a-Beneficiary-Understanding-Life-Insurance-Choices-575dabf93df78c98dc5b4b2d.jpg) Choosing Beneficiaries For Your Life Insurance Policy

Choosing Beneficiaries For Your Life Insurance Policy

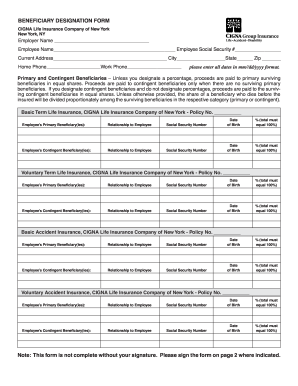

Life Insurance Beneficiary Primary Vs Contingent See

Life Insurance Beneficiary Primary Vs Contingent See

How To Name Life Insurance Beneficiaries Entrepreneurship In A Box

How To Name Life Insurance Beneficiaries Entrepreneurship In A Box

What Is A Life Insurance Beneficiary Your Will Can T Override It

What Is A Life Insurance Beneficiary Your Will Can T Override It

New Life Insurance Beneficiary Form From Zenith American Solutions

New Life Insurance Beneficiary Form From Zenith American Solutions

Analyze The Beneficiaries Of Life Insurance Policy

Analyze The Beneficiaries Of Life Insurance Policy

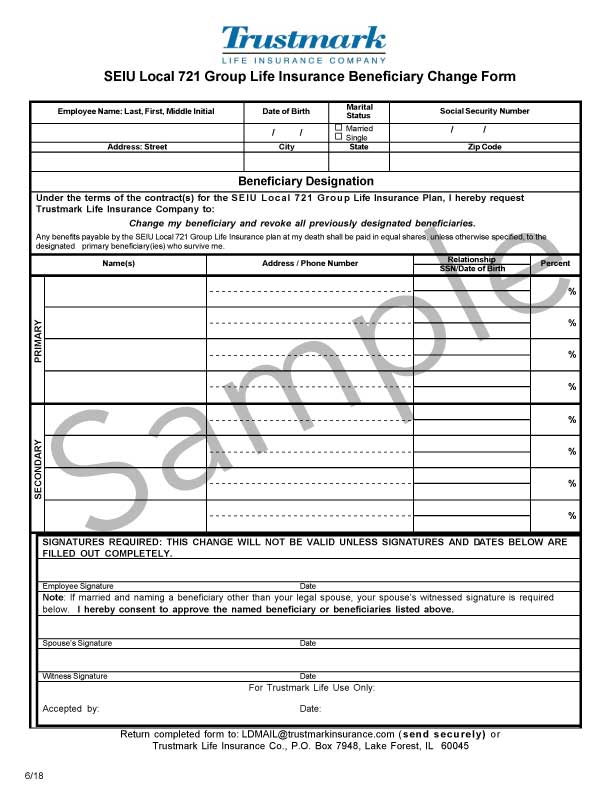

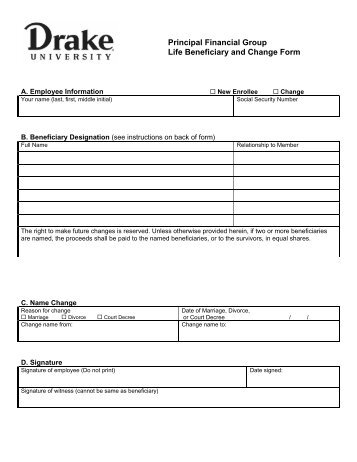

How To Change The Beneficiary On Your Life Insurance

How To Change The Beneficiary On Your Life Insurance

How To Change Life Insurance Beneficiary

How To Change Life Insurance Beneficiary

Understanding The Process For Life Insurance Beneficiaries That

Understanding The Process For Life Insurance Beneficiaries That

Choosing Life Insurance Beneficiaries

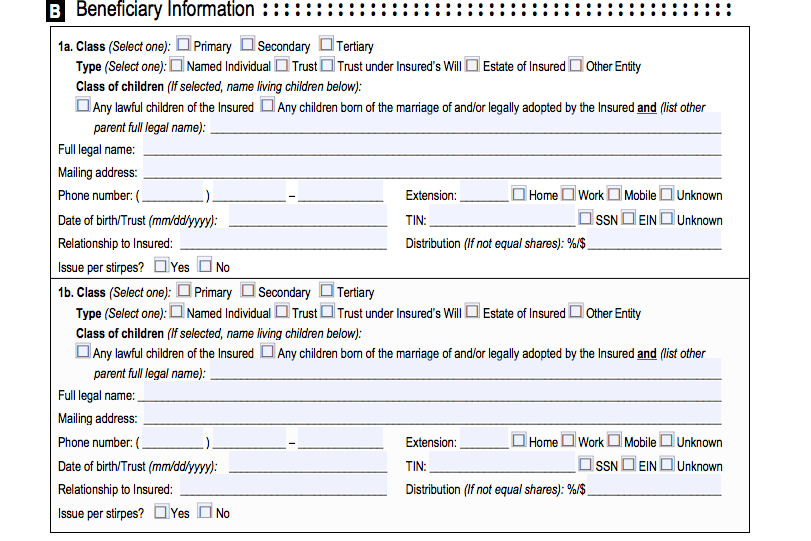

Cigna Life Insurance Beneficiary Form Fill Out And Sign

Cigna Life Insurance Beneficiary Form Fill Out And Sign

Life Insurance Beneficiaries Primary Contingent Minor Aged

Life Insurance Beneficiaries Primary Contingent Minor Aged

Designating A Beneficiary For Life Insurance Robert A Rocky

Choosing A Life Insurance Beneficiary That Is A Minor

What Not To Do When Choosing Life Insurance Policy Beneficiaries

What Not To Do When Choosing Life Insurance Policy Beneficiaries

Form 29 336 Designation Of Beneficiary Government Life Insurance